We are excited to announce Wauna Credit Union’s next step in ensuring we offer our members only the best products and services. In June, we are updating our credit cards to provide an enhanced experience to thank those who continue to support local business by banking locally.

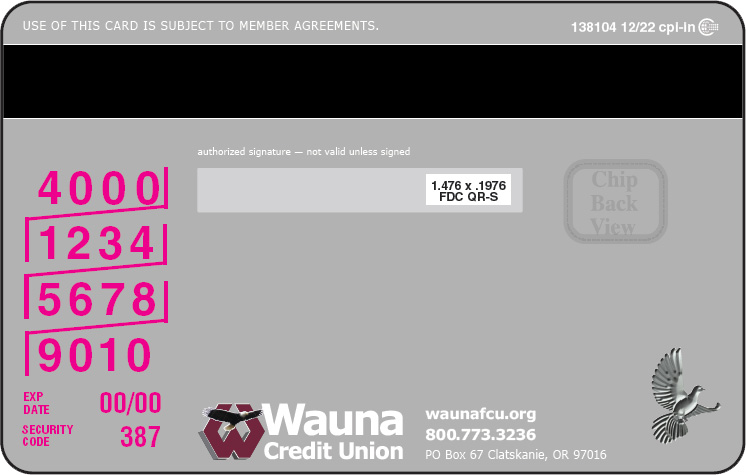

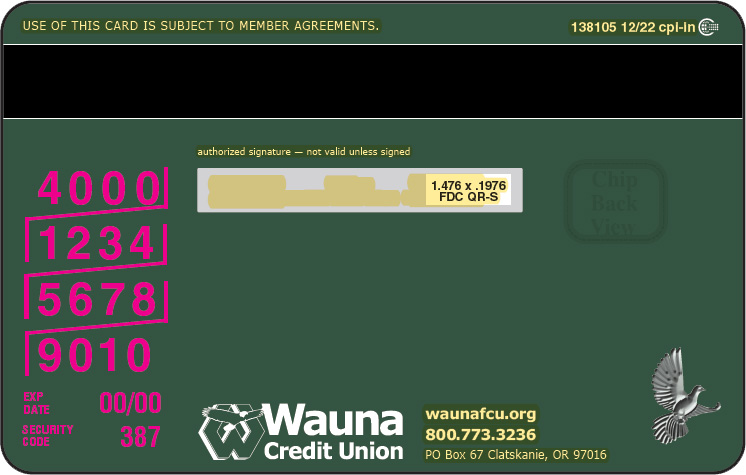

Our new cards introduce contactless payment, and have increased security protections to keep your identity and your money safe. You will continue to have the benefits you’ve grown accustomed to, like Mobile Wallets, Visa 3D Secure, and Account Updater. The new cards even have an updated look designed to evoke the beauty of the natural world around us.

Next Steps

Be on the lookout for your new card, which will be arriving in your mailbox in early June. The new cards have a different design than existing WCU cards. If you have a WCU Rewards Visa, your new card will be green with eagle feathers. If you have a WCU Platinum Visa your new card will be grey with eagle feathers.

Simply follow the instructions on the card when you get it in the mail, update your automatic payments to your new credit card number, and you’re ready to go. Your payment date, credit card rate, terms, and limits all remain the same. We’ll even transfer any rewards points you have over to the new card.

Timing

Remember, you will first need to call the number on your card’s sticker to activate it. Please activate on Sunday, June 25th (cannot activate early). Once you have activated your new card, ensure it is in working condition by making a transaction. Please use your current card through Saturday, June 24th, which is the last day you can do so.

If you have any questions for us about your new cards, please call us at 800-773-3236, use the chat function in U banking, contact us with Wauna CU Now, or visit your local branch.

Unfortunately, we live in a world where data security simply isn’t as secure as it should be. And this week, we’ve learned of yet another major breach. A hack at

Unfortunately, we live in a world where data security simply isn’t as secure as it should be. And this week, we’ve learned of yet another major breach. A hack at

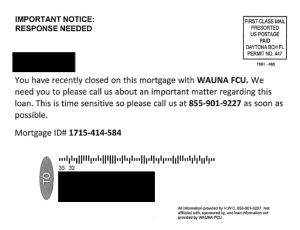

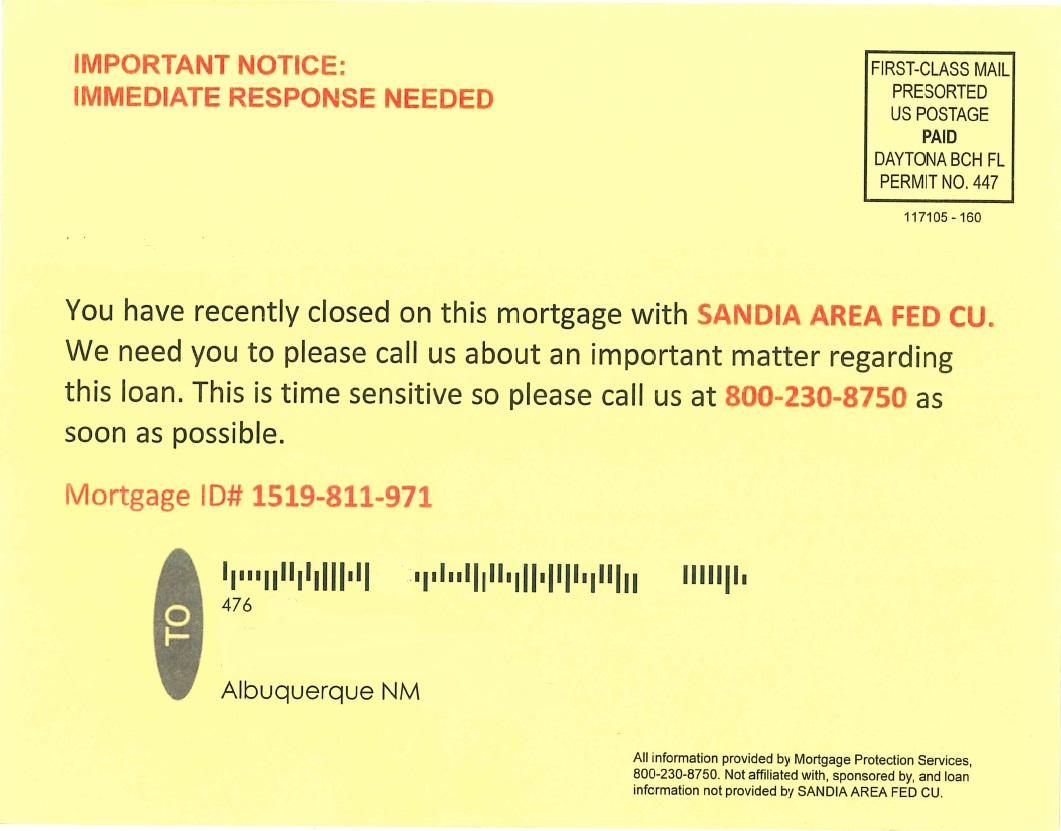

Darn right we called the number. In fact, we tried all the numbers we were able to find. Some connect to a live person, others are recordings, and one dialed directly to an automated system. Regardless of which number, we were eventually probed for personal information. Funny enough, these fraudsters refuse to give out any information about themselves, or even the actual company they are working with.

Darn right we called the number. In fact, we tried all the numbers we were able to find. Some connect to a live person, others are recordings, and one dialed directly to an automated system. Regardless of which number, we were eventually probed for personal information. Funny enough, these fraudsters refuse to give out any information about themselves, or even the actual company they are working with.

Skimmers are sneaky little devices, which fraudsters affix to ATMs or other machines that accept credit or debit card transactions. The skimmer then secretly swipes your card information whenever you slip your card into the affected machine. These pesky gadgets have been around for years. But thieves are continually improving them and their usage doesn’t seem to stop!

Skimmers are sneaky little devices, which fraudsters affix to ATMs or other machines that accept credit or debit card transactions. The skimmer then secretly swipes your card information whenever you slip your card into the affected machine. These pesky gadgets have been around for years. But thieves are continually improving them and their usage doesn’t seem to stop!

different than what should be expected.

different than what should be expected.

We are now offering compliant, transparent banking services to

We are now offering compliant, transparent banking services to