Embracing a Legacy of Financial Empowerment

The credit union movement evolved from the cooperative activities of early 19th century Europe, and began with a simple idea: that people could pool their money and make loans to each other.

The first of these cooperatives was an 1844 marketing cooperative organized by a group of workers in Rochdale, England. The idea of credit societies was a part of this effort, and in 1846 the first true credit union in the 19th century was founded.

Every year, on the third Thursday of October, credit unions around the world come together to celebrate International Credit Union Day. This year is particularly special as we mark the 75th anniversary. Since our inception, credit unions have been at the forefront of providing financial services that empower individuals and communities, and this milestone is a testament to the enduring impact they’ve had.

Focused on People, Not Profits

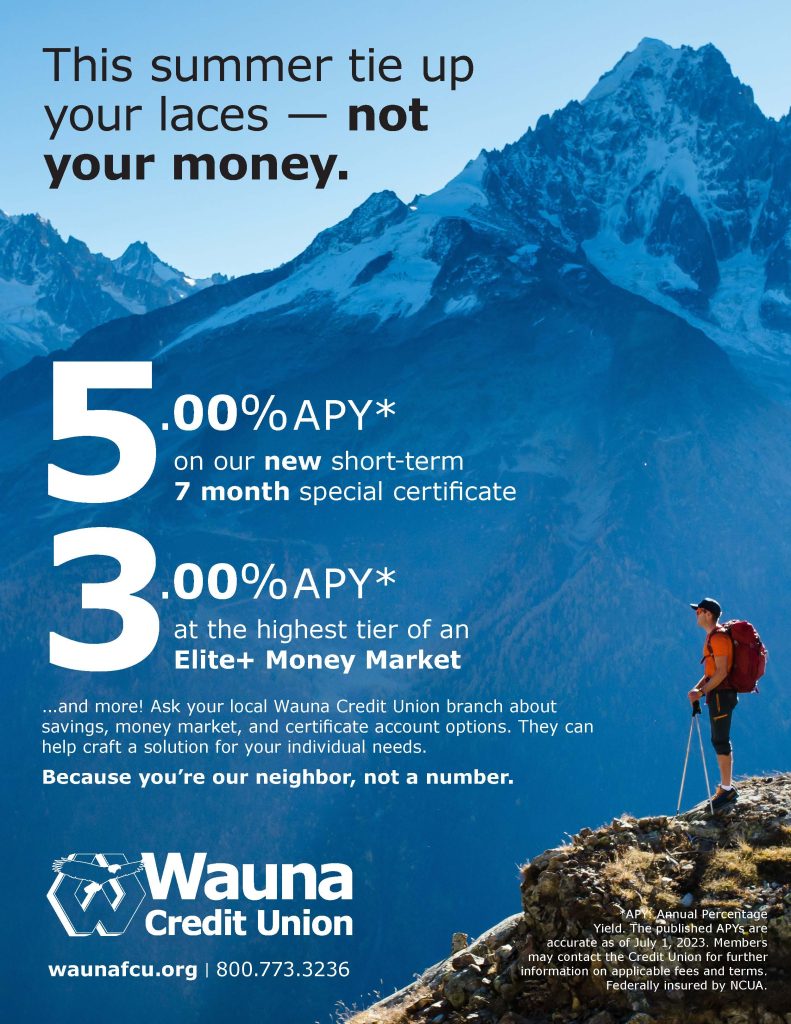

Credit unions prioritize members’ well-being over profits. Unlike traditional banks, which are driven by maximizing profits for shareholders, credit unions are member-owned. This means that every member is a part-owner and has a voice in the institution’s decision-making process. The result of this is credit unions usually have lower rates on loans, higher returns on deposits, and more flexibility when working with individuals.

Strengthening Communities, One Member at a Time

For 75 years, credit unions have played a pivotal role in building and strengthening communities. We offer almost all of the same products that the banks do, but tailor those products to meet the diverse needs of the people and businesses in our communities.

Embracing Innovation, Preserving Values

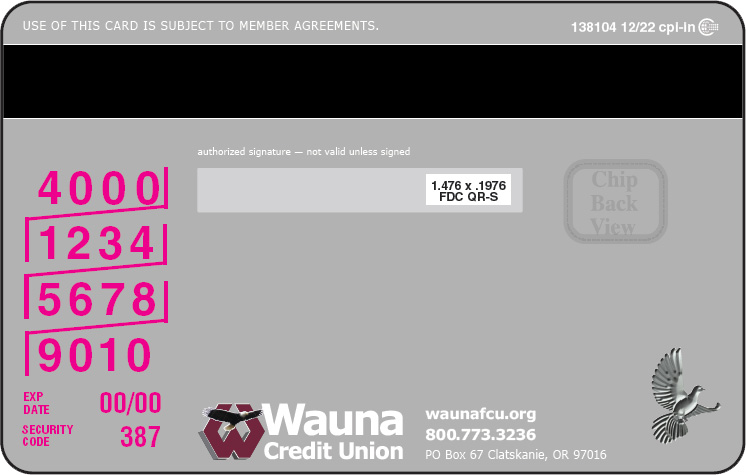

In today’s rapidly changing financial landscape, credit unions continue to adapt and innovate to meet the evolving needs of their members. From the best digital banking solutions to personalized financial education programs, credit unions are harnessing the power of technology while staying true to their cooperative values.

Join Us in Celebrating International Credit Union Day

As we mark the 75th International Credit Union Day, we invite you to join us in celebrating this remarkable milestone. We’re proud to be part of a global movement that prioritizes people and communities above all else. Together, we’ll continue to empower individuals, strengthen communities, and build a brighter financial future for all.

Happy 75th International Credit Union Day