We’ve been super busy at WCU over the last three months. From promotions like our Adopt-a-Teacher program, to (ceremonially) breaking ground on our new branch in Forest Grove and dedicated the stage in St. Helens, we’ve gotten a lot of attention from the press recognizing our work for our members. We’ve highlighted them below.

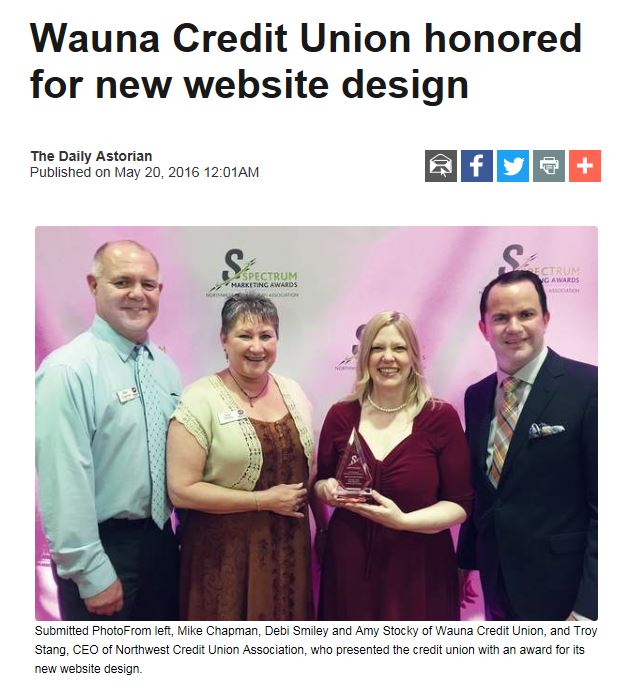

Tri-City Insurance becomes part of Wauna Credit Union (The Chronicle)

Wauna Credit Union recently acquired the agency in a merger deal, which came right before the retirement of longtime owner and founder Glenda Worthington. The insurance company is now owned and operated under Wauna Services, LLC. Aside from non-members who want insurance services, Smiley said that the acquisition will also help give credit union members more options for insurance services. She added that in terms of auto loans and home ownership options, the services go “hand-in-hand.”

Wauna Credit Union announces Adopt-A-Teacher contest (The Chronicle)

As the school year begins, Wauna Credit Union proudly supports the teachers in the communities it represents. To help area teachers, who often have to dig into their own pockets to provide supplies for the classroom, the credit union is hosting an “Adopt-A-Teacher” contest during the month of September, awarding $500 to the winning educator.

‘Adopt-A-Teacher’ contest will net winner $500 (The Daily Astorian)

To help area teachers, who often have to dig into their own pockets to provide supplies for the classroom, Wauna Credit Union is hosting an “Adopt-A-Teacher” contest in September, and awarding $500 to the winning educator. Community members are encouraged to post a video on WCU’s Facebook page explaining why their favorite teacher deserves to win. The entry with the most votes as measured by Facebook “reactions” wins the grand prize.

Health & Safety Fair: Community Collaboration (The Chief)

Many vendors and presenters lined up tables throughout the Clatskanie Middle/High School cafeteria, entertaining and feeding more than 200 people at the Health and Safety Fair on Sept. 23. Event organizers included representatives from Columbia County United Way, Clatskanie School District, Clatskanie Rural Fire Protection District, Wauna Federal Credit Union, and Clatskanie PUD.

Credit union breaks ground on long-vacant FG lot (Forest Grove NewsTime)

Forest Grove city leaders and Wauna Federal Credit Union representatives held a groundbreaking ceremony at the lot Thursday, Sept. 21. “To have one of the blank spots in our community filled with a building a year from now — that’ll be tremendously beneficial to Forest Grove,” said Forest Grove/Cornelius Chamber of Commerce Director Howard Sullivan. “Forest Grove will have a different look and feel now as people come into town.”