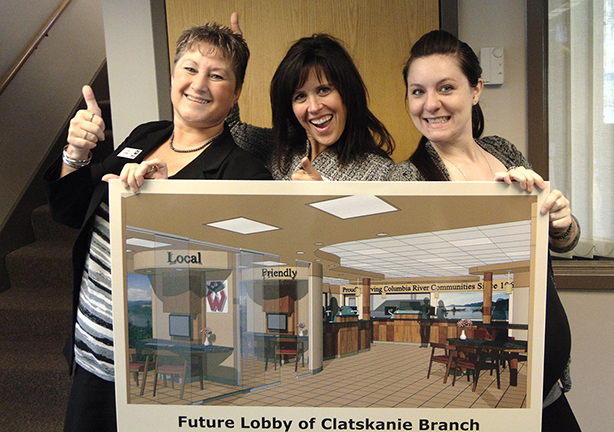

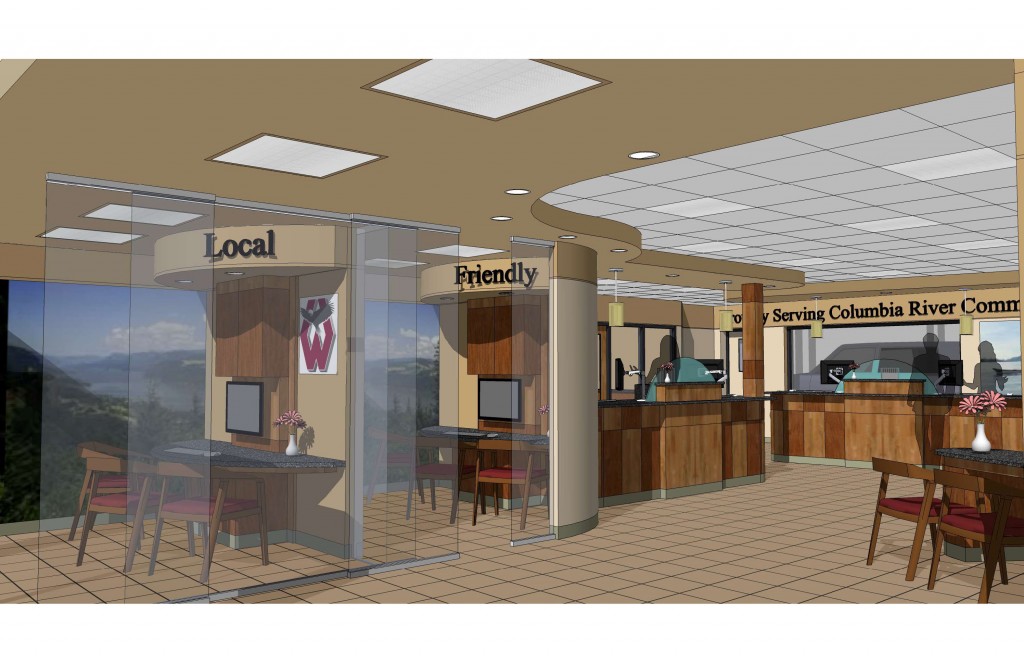

Big News! Wauna Credit Union is absolutely delighted to begin a major remodel of our Clatskanie branch, starting on Friday, April 8th! Regular visitors already know that furnishings are getting sparse inside the branch as we prepare for the construction crew to come in.

The Clatskanie branch will be closed on Friday, April 8th to get things rolling, it will reopen on Monday, April 11th utilizing only half the building, and then in a few weeks will switch over to using the other half. The Clatskanie branch will remain open during construction, which is expected to be finished in Mid-June.

Our ATM and Night Drop will be available, but our Drive Up window will be closed during this time. We apologize for this inconvenience and ask that you please pardon our dust as we create a brand new branch experience for our members, and more (desperately needed) space upstairs for our support staff!

Check back for updates & info direct from the remodel!

Clatskanie Branch Remodel Important Dates:

- Starts April 8th (Branch will be closed for this one day).

- April 11th, branch reopens, construction is ongoing.

- Drive up window will be closed from April 8 until Mid June.

- ATM & Night Drop will be open.

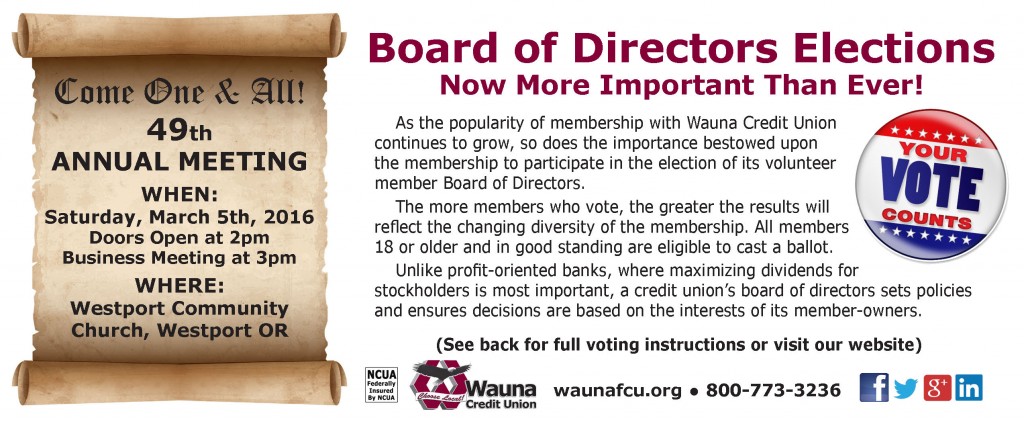

![Go-Vote-500x500[1]](https://waunafcu.org/blog/wp-content/uploads/Go-Vote-500x5001-300x300.png)

![Online-Security-21[1]](https://waunafcu.org/blog/wp-content/uploads/Online-Security-211-300x184.jpg)