WCU Member consultant Jaleese could tell right away that the member walking into the Astoria branch was under a lot of stress. “Sometimes you can just tell,” she said. “Once he got to the counter, I knew immediately why.”

The member was looking to get a cashier’s check for almost $10,000 in order to post bail for his grandson in California. Something about the story didn’t sound right to Jaleese. As part of her training, she studied the different types of financial scams, and the member’s story had some of the indicators of a classic fraud. There was a ton of urgency placed on the member, after all his grandson was sitting in a jail cell, and bail can only be paid with cash or a cash substitute, that means once it’s handed over, there’s no way to get the money back.

Jaleese was suspicious. She talked with the member and he agreed to let her try to find out a bit more. He told her the name of the county in California he was told the jail was in, and Jaleese went to work. She contacted the county, as well as multiple local bail bonds services. None of the places she called were able to confirm the nephew was lodged in a local jail.

Unable to confirm any of the details the member was told, Jaleese was pretty sure it was fraud. She went over her suspicions with the member, and he agreed to contact his grandson, and the grandson’s parents before getting the cashier’s check. Later in the day, Jaleese got the call she was expecting. The grandson was fine. The member was relieved, and more importantly, he didn’t lose his hard-earned money.

“It really bothers me that people pray on other people by putting them in a stressful situation,” Jaleese said. “I was really happy to hear everything was okay. The great thing about working for a local company is we can take the time to make sure we’re doing everything we can to help people. Usually that means helping them get something they need, but saving somebody that much money really made my day.”

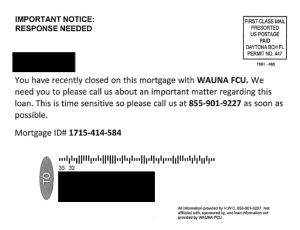

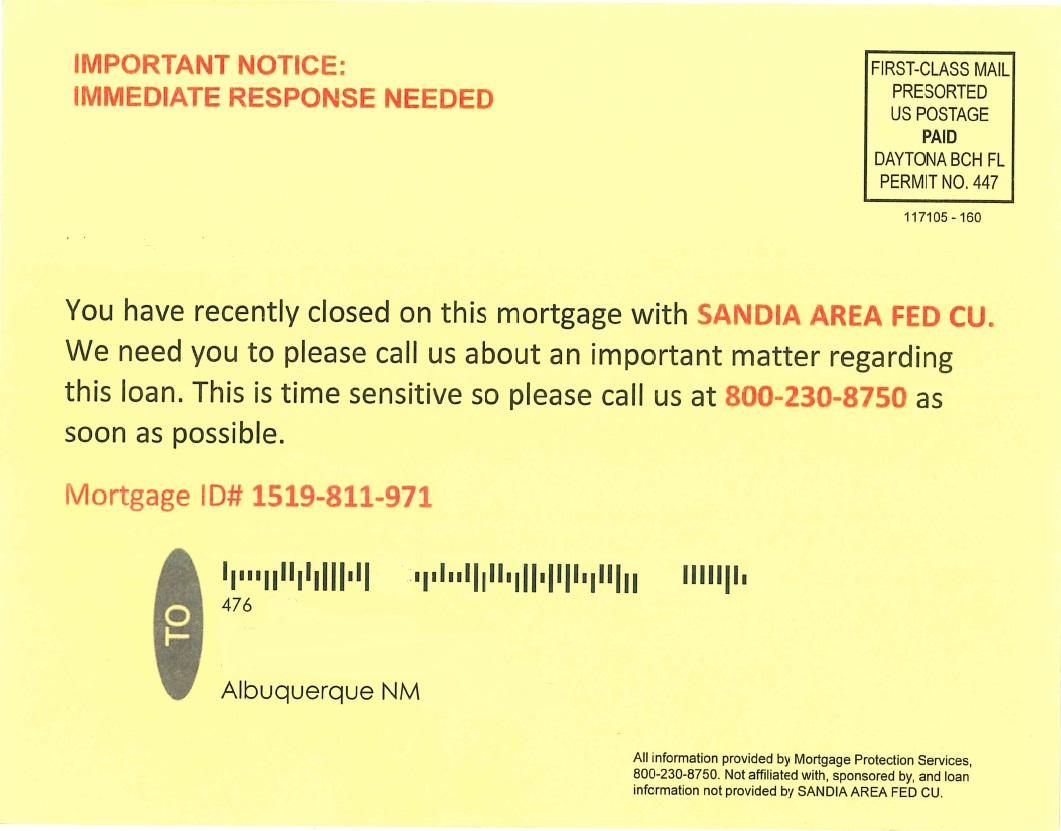

Darn right we called the number. In fact, we tried all the numbers we were able to find. Some connect to a live person, others are recordings, and one dialed directly to an automated system. Regardless of which number, we were eventually probed for personal information. Funny enough, these fraudsters refuse to give out any information about themselves, or even the actual company they are working with.

Darn right we called the number. In fact, we tried all the numbers we were able to find. Some connect to a live person, others are recordings, and one dialed directly to an automated system. Regardless of which number, we were eventually probed for personal information. Funny enough, these fraudsters refuse to give out any information about themselves, or even the actual company they are working with. Skimmers are sneaky little devices, which fraudsters affix to ATMs or other machines that accept credit or debit card transactions. The skimmer then secretly swipes your card information whenever you slip your card into the affected machine. These pesky gadgets have been around for years. But thieves are continually improving them and their usage doesn’t seem to stop!

Skimmers are sneaky little devices, which fraudsters affix to ATMs or other machines that accept credit or debit card transactions. The skimmer then secretly swipes your card information whenever you slip your card into the affected machine. These pesky gadgets have been around for years. But thieves are continually improving them and their usage doesn’t seem to stop!

different than what should be expected.

different than what should be expected.