ANNUAL MEETING & BOARD NOMINEE NOTICE

OUR 55TH ANNUAL MEETING WILL BE HELD ON MARCH 8TH AT 6:30pm

ERLENE DARBY LEARNING CENTER | 49249 HWY 30 | WESTPORT, OR

The Board of Directors has approved three nominees for three positions on the Board of Directors from applications submitted by members. Their names and biographical information are included below.

JILL HULT • MEMBER SINCE 2018 • ASTORIA, OR – Jill Hult has been serving on the Board of Directors since 2019. She currently owns I Communicate You—a job development business—and additionally provides résumé and cover letter writing services. Jill recently received a provisional certification as a benefit planning counselor for people who are on SSI/SSDI. Jill will be returning to school to complete her Master’s Degree in Communications at PSU. In her spare time, Jill enjoys spending time with family and friends, volunteering, writing and participating in Vernonia Writer’s Group, hiking, riding bicycles or four wheelers, playing some pickle ball, puzzles, dancing, and yes, admittedly, karaoke!

BETH VAN ELSWYK • MEMBER SINCE 2007 • VERNONIA, OR – Beth van Elswyk is a co-founder/partner of Wiesow Management, an Industrial Hemp Services and Supply company. Beth thrives in the chaos of growth and change with a focus on customer service and training campaigns to create ROI. She credits her ongoing success in challenging business climates to a combination of Matshushita and Drucker Management principles. After a long-term commitment with SMMR Sergeant McDowell’s Military Relief as VP, she now serves on the Hemp Task Force for ASTA American Seed Trade Association and speaks on hemp and regenerative agriculture at various non-profits. When she isn’t hempin’, you’ll find Beth flying her drones at various North Coast scenic venues, creating video content, or with her wife in Long Beach, WA at Funland earning arcade points to win small kitchen appliances.

GEORGE DUNKEL • MEMBER SINCE 2009 • SCAPPOOSE, OR – George Dunkel was born in Astoria and resided in the community of Wauna before moving to Scappoose. He graduated from Linfield College, spending three years in management training with Western Bank in St. Helens. George served as Fire Chief of Columbia River Fire & Rescue for seven years and currently serves as Chair of the Oregon Fire Chiefs Foundation. He also serves on the board of the International Fire Service Training Association and as a member of the Kiwanis Club of St. Helens. George works with local governments as the Administrator of the Consulting Services Program for Special Districts Association of Oregon and believes that his experience, good natured personality, and proactive approach to challenges will assist WCU in meeting its vision. He and his wife of 36 years, Vicki, enjoy their three married daughters/sons-in-law and six grandchildren.

An election will not be conducted by ballot, and there will be no nominations from the floor at the annual meeting when the number of nominees equals the number of positions to be filled, which is currently the situation. Any member who desires to run for the Board may do so now only by a nomination by petition signed by 270 credit union members in good standing 18 years of age or older. An application may be requested by calling 1-800-773-3236, Ext 3124. Completed applications may be mailed to ATTN: Governance Committee P.O. Box 67 Clatskanie, OR 97016 or delivered in person to any branch. Petition applications must be received by close of business on February 1, 2022.

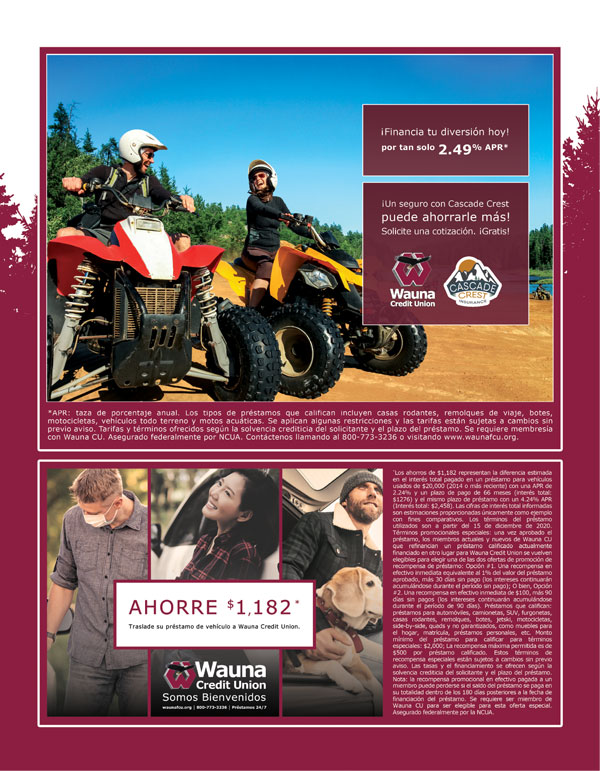

CHOOSE YOUR OWN LOAN ADVENTURE

waunafcu.org 800.773.3236

- No payments for 90 days and $100

OR - 1% cash reward and no payments for 30 days

Promotion Special Terms: Upon loan approval, current and new members who refinance a qualifying loan currently financed elsewhere to Wauna Credit Union become eligible to choose one of two Loan Reward Promotion offers: Option #1. An immediate Cash Reward equal to 1% of the approved loan value, plus 30-Days No Payment (interest will continue to accrue during the No Payment period); Or, Option #2. An immediate $100 Cash Reward, plus 90-Days No Payments (interest will continue to accrue during the 90-day period). Qualifying Loans: Auto, Truck, SUV, Van, Motor home, trailer, boat, watercraft, motorcycles, side-by-sides, quads, and unsecured loans such as home furnishings, tuition, personal loans, etc. Minimum loan amount to qualify for special terms: $2,000; Maximum Reward allowed is $500 per qualifying loan. These special Reward terms are subject to change without notice. Rates & financing are offered based on applicant’s credit worthiness and term of the loan. This promotional offer ends on June 30, 2022. Note: the promotional cash reward paid to a member may be forfeit if the loan balance is paid in full within 180-days of the loan funding date. Membership with Wauna CU required to be eligible for this special offer.