HERE and NOW CERTIFICATE

Our only mission is to provide opportunities for

our members to build their financial well-being.

July 2018 2.018%* APY

13-Month

$500 Min.

Enjoy “Here & Now” Rate! Reach your savings goals faster!

Now is the time to put your savings to work for you! Make the

most of what you have without the risk of stocks or other more volatile

investments. Enjoy our “Here & Now” Certificate Special, and turn up the

volume on that passive income.

*APY=Annual Percentage Yield. This special Certificate Account is for New Money only for a term of 13 months and offers an APY of 2.018%; the Dividend Rate is 2.00%. Deposits to this account may not originate from another Wauna Credit Union deposit account. Minimum deposit required to open this special

Certificate account and to obtain the published APY: $500.00. Deposits from other Wauna CU accounts may be accepted into the new Certificate Account once the New Money minimum deposit equals $10,000. Some fees could reduce earnings. This special 13-Month Certificate also available as an IRA. Early withdrawal penalty: We may impose a penalty if you withdraw any of the principle before the maturity date, or the renewal date if it is a renewal account. This special offer is available July 2, 2018, through July 31, 2018, and may be terminated

without notification. Membership with Wauna Credit Union required to be eligible for this special offer. Please contact Wauna Credit Union for membership eligibility details. All deposits up to $250,000 are insured by the National Credit Union Administration, and backed by the full faith and credit of the U.S. government.

Wauna Credit Union

waunafcu.org l 800-773-3236

NMLS# 421867

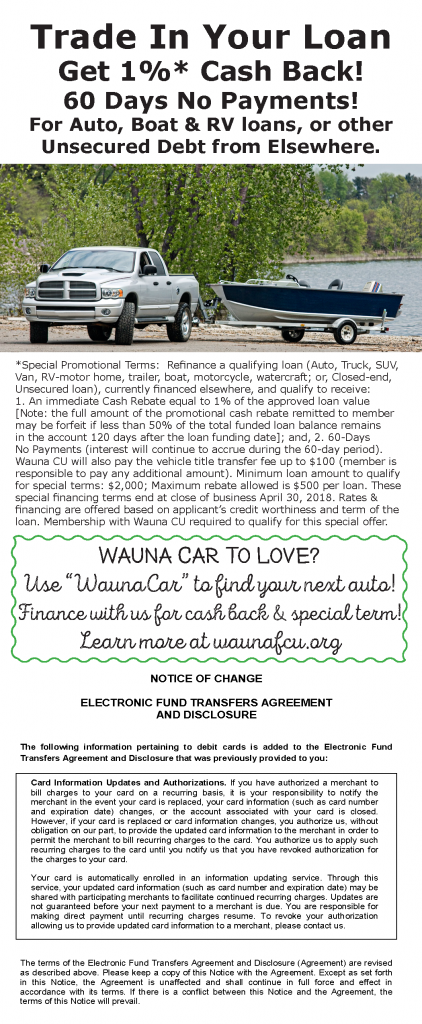

Summer Is For FUN & We Make Fun Affordable!

Wauna Credit Union offers affordable loans for RVs, boats, motorcycles and other fun & sun loving vehicles to make your days memorable.

Take that cross country RV trip with your family, motorcycle through the mountains, boat down the coast, or jet ski your local lake or river.

You can follow the fun, without breaking your budget. Stop delaying your adventure and apply today!

Apply 24/7 800-773-3236 waunafcu.org

60 Days No Payments on RVs, Boats, Motorcycles!

New/Used purchases qualify for 60-Days No Payments.

1% Cash Rebate AND 60-DaysNo Payments for Refinances

from elsewhere!

Promotional terms available July 9 – August 31, 2018.

*Special Promotion Terms: New & used RV-Recreational Vehicle (includes: motor home, trailer, boat, motorcycle, ATV, side-by-sides, watercraft) loans qualify for 60-Days No Payments (interest will continue to accrue during the 60-Day period). Maximum Loan: $50,000. Qualifying loans refinanced from elsewhere to Wauna CU receive: 1. An immediate Cash Rebate equal to 1% of the approved loan value [Note: the full amount of the promotional cash rebate remitted to member may be forfeit if less than 50% of the total funded loan balance remains in the account 120 days after the loan funding date]; and, 2. 60-Days No Payments (interest will continue to accrue during the 60-day period). Minimum loan amount to qualify for special terms: $2,000; Maximum Loan: $50,000; maximum rebate allowed is $500 per loan. These special financing terms end at close of business August 31, 2018. Rates & financing are offered based on applicant’s credit worthiness and term of the loan. Membership with Wauna CU required to qualify for this special offer.

Our 2018 Scholarship Winners

Wauna Credit Union is thrilled to announce our 2018 Scholarship recipients. This year, we had so many amazing applicants, we actually added more money to our scholarship fund! We gave $11,500 in support to our member student this year!

Congratulations to the following:

Hannah Mather, Astoria

Jordan Kenney, Clatskanie

Madeline Moravec, Clatskanie

Maisy Horness, Clatskanie

Chloe Davidson, Clatskanie

Autumn Crawford, Clatskanie

Alaina Schwartz, Clatskanie

Sierra Bechdoldt, Clatskanie

Jaden Miethe, Knappa

Megan Clark, Rainier

Nada Jones, Rainier

Kaitlyn Bakkensen, Scappoose

Madelynn Hall, Scappoose

Payton Wolf, Vernonia

Bethany Stockwell, Vernonia

Odessa Roberts, Vernonia

Rebekah Barnes, Vernonia

Grace Travis, Warrenton

Go Places With VISA

Be sure to take a Wauna Credit Union VISA Credit Card on your travels – safer than cash or Debit Cards & very affordable! We also offer loans for that dream vacation you’ve been wanting to take – the kids keep getting older.

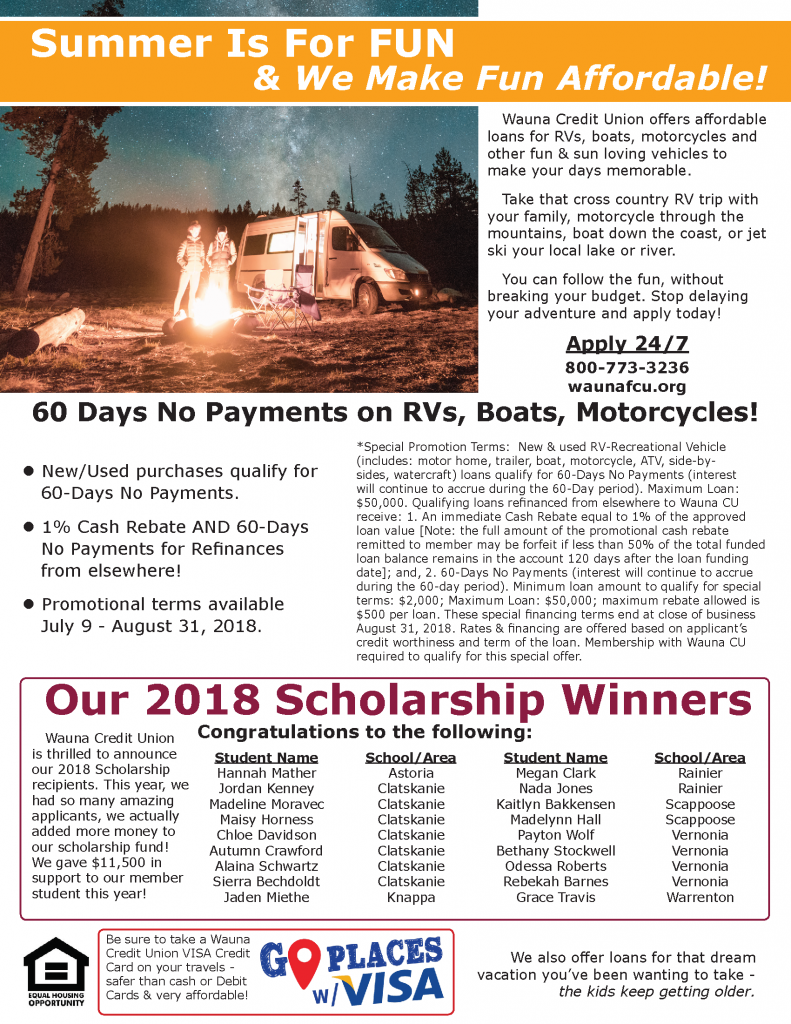

Wauna Credit Union Fee Changes

Effective August 15, 2018

Cards

Card payment by phone

$15.00

per

transaction

Non-CO-OP ATM withdrawals

$2.50

per

withdrawal

Safe Deposit Boxes

3” x 5” Box

$35.00

annually

3” x 10” Box

$50.00

annually

5” x 10” Box

$60.00

annually

10” x 10”

$85.00

annually

SDB Late Fee

(<30 days)

$20.00

per month

Services

Account research/Balancing

$45.00

per hour (min 1 hour)

Carfax

$20.00

per item

Dormant Account (12 mo. inactivity)

$10.00

monthly

Legal Process Fee (Garnishment/Levy)

$125.00

per item

Line Of Credit over limit fee

$35.00

per item

Skip-A-Payment

$40.00

per skip

Stop Payment

$30.00

per item

Unclaimed

Property Notices

$15.00

per item

Undeliverable Mail Fee

$10.00

per item

Wires

Intl. Wire Research or Tracking

$45.00

per item

Business Accounts

Money Services Business Checking

– Cash Handling

Fee >$150k

$35.00

monthly

$15.00

per $25k increment

Line of Credit Renewal

$250.00

per item

Questions? Contact us at

800-773-3236 or waunafcu.org.

Find a full rate sheet at

waunafcu.org or at any branch.

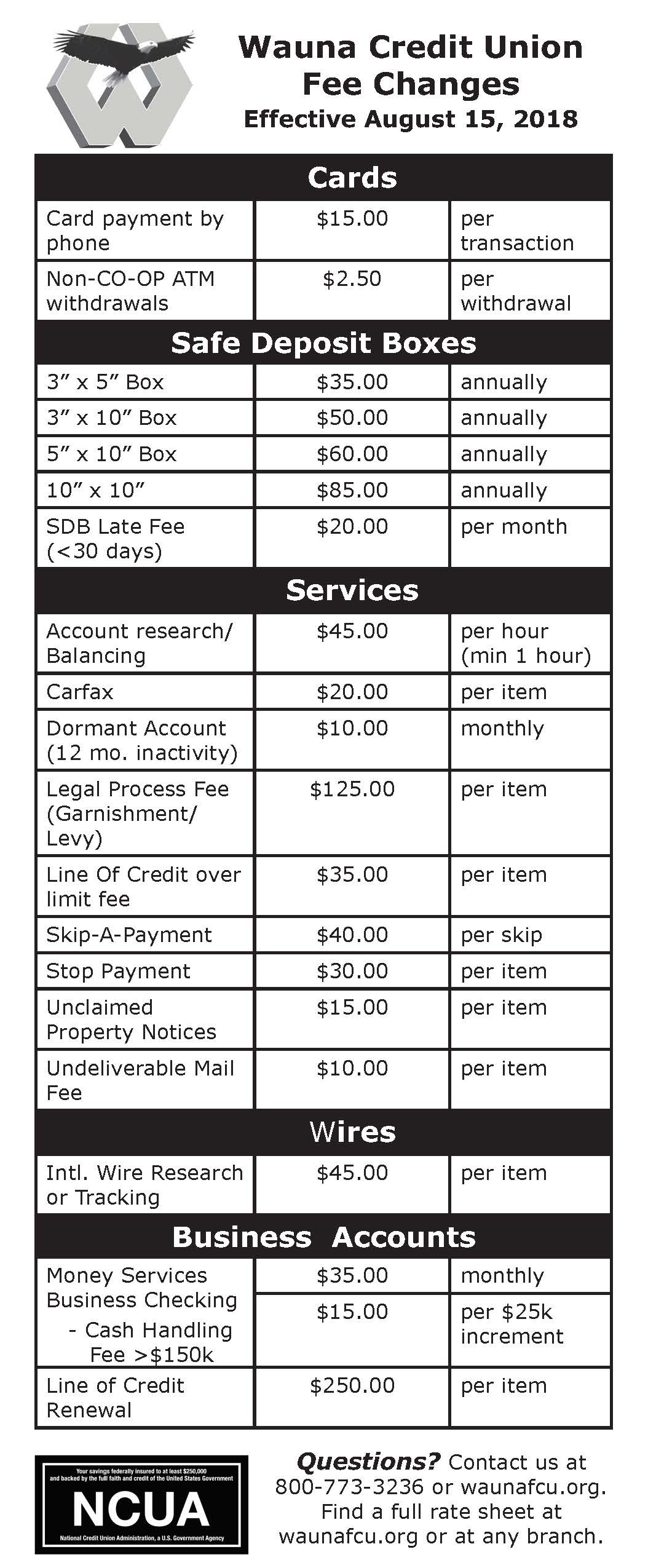

WAUNA CREDIT UNION

MEMBERSHIP &

ACCOUNT AGREEMENT

Summary of Changes to Account

Agreement and Disclosures 2018

Revised Aug. 1, 2018

Funds Availability Policy

Section 1- General Policy

Added to end of section: Interactive Teller Machines (ITMs): When

the ITM is staffed, deposits are being made at a staffed facility. When

the ITM is not staffed, deposits are being made at an ATM. The funds

will be made available according to the General Policy.

Membership & Account Agreement

Section 8a. Endorsements

Added to end of paragraph: For mobile deposits, we may refuse

checks lacking a restrictive endorsement, such as “for mobile deposit

only”.

Section 26. Inactive Accounts

Deleted from first sentence: “your account falls below any minimum

balance”. Minimum balance is not needed along with inactivity for

specified period for account to be classified as inactive or dormant.

4th sentence was deleted: You authorize us to transfer funds from

another account of yours to cover any service fees, if applicable. To

the extent allowed by law, we reserve the right to transfer the account

funds to an account payable and to suspend any further account

statements.

Section 29. Termination of membership

Added to end of paragraph: A member who fails to complete

payment of one share within 3 months of admission to membership,

or within 3 months from the increase in the par value of shares or

a member who reduces the share balance below the par value of

one share, either through voluntary withdrawal of funds or through

involuntary assessment of fees and charges, and does not increase the

balance to at least the par value of one share within 3 months of the

reduction will be terminated from membership.

Electronic Funds Transfer

Section 1. EFT Services, b. Debit Card

Added to end of section: Card Information Updates and

Authorizations. If you have authorized a merchant to bill charges to

your card on a recurring basis, it is your responsibility to notify the

merchant in the event your card is replaced, your card information

(such as card number and expiration date) changes, or the account

associated with your card is closed. However, if your card is replaced

or card information changes, you authorize us, without obligation on

our part, to provide the updated card information to the merchant in

order to permit the merchant to bill recurring charges to the card. You

authorize us to apply such recurring charges to the card until you notify

us that you have revoked authorization for the charges to your card.

Your card is automatically enrolled in an information updating service.

Through this service, your updated card information (such as card

number and expiration date) may be shared with participating

merchants to facilitate continued recurring charges. Updates are not

guaranteed before your next payment to a merchant is due. You are

responsible for making direct payment until recurring charges resume.

To revoke your authorization allowing us to provide updated card

information to a merchant, please contact us.

Under her leadership, I learned to “stay focused, work hard, and have fun”. That was her motto and she shared it often. Eileen led by example. She was a compassionate leader that believed in the credit union, what we stood for and the high quality of service we were to render. She was a caring and supportive leader and I feel privileged to have worked under her leadership and guidance.

Under her leadership, I learned to “stay focused, work hard, and have fun”. That was her motto and she shared it often. Eileen led by example. She was a compassionate leader that believed in the credit union, what we stood for and the high quality of service we were to render. She was a caring and supportive leader and I feel privileged to have worked under her leadership and guidance.

We are now offering compliant, transparent banking services to

We are now offering compliant, transparent banking services to