Visa for every Individual

Don’t miss getting your VISA Rewards card

Apply through July and get up to 30,000 Bonus Points*

Get the card that plays!

3.49% Intro APR* For VISA Rewards so you can play and get paid

Standard Rate after Intro Period: 11.15% APR – 17.90% APR

10,000 Bonus Points** After registering at scorecardrewards.com

20,000 Bonus Points** After account balance exceeds $999.99

Check out our VISA Platinum card with a 2.99% Intro APR* at waunafcu.org

Standard Rate after Intro Period: 9.90% APR – 17.90% APR

*APR: Annual Percentage Rate. This special offer is exclusive to new VISA platinum or Rewards credit card accounts opened on or before July 31, 2019. The special 6-Month Introductory Rate periods (Platinum 2.99% APR; Rewards 3.49% APR) apply to purchase balances for a maximum of 6 billing cycles following the account opening date. Qualifying Rewards credit card accounts are eligible to earn up to 30,000 Bonus Reward Points : 20,000 Points if their account balance exceeds $999.99 on or before August 31, 2019; and/or 10,000 Bonus Points when the account holder creates logon credentials and accesses the Scorecard

Rewards website on or before August 31, 2019. Some restrictions apply; Membership with Wauna Credit Union is required. This promotional offer ends July 31, 2019. Promotional details available at waunafcu.org.

24/7 Lending, waunafcu.org, 1-800-773-3236

Individual Homeowners Welcome

Eric & Jessica, Warren

Cascade Crest Insurance

Save Up to 25%

When you bundle home and auto

Cascade Crest Insurance

Auto, home, renters, life, business

www.cascadecrestinsurance.com

Individuals Welcome at Wauna Credit Union

Apply 24/7, waunafcu.org, 800-773-3236

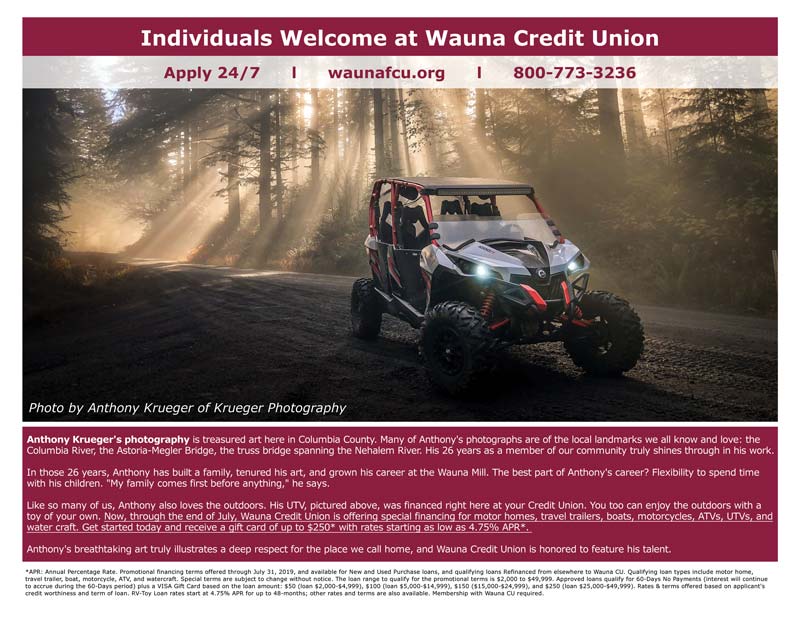

Anthony Krueger’s photography is treasured art here in Columbia County. Many of Anthony’s photographs are of the local landmarks we all know and love: the Columbia River, the Astoria-Megler Bridge, the truss bridge spanning the Nehalem River. His 26 years as a member of our community truly shines through in his work. In those 26 years, Anthony has built a family, tenured his art, and grown his career at the Wauna Mill. The best part of Anthony’s career? Flexibility to spend time with his children. “My family comes first before anything,” he says. Like so many of us, Anthony also loves the outdoors. His UTV, pictured above, was financed right here at your Credit Union. You too can enjoy the outdoors with a toy of your own. Now, through the end of July, Wauna Credit Union is offering special financing for motor homes, travel trailers, boats, motorcycles, ATVs, UTVs, and water craft. Get started today and receive a gift card of up to $250* with rates starting as low as 4.75% APR*. Anthony’s breathtaking art truly illustrates a deep respect for the place we call home, and Wauna Credit Union is honored to feature his talent.

*APR: Annual Percentage Rate. Promotional financing terms offered through July 31, 2019, and available for New and Used Purchase loans, and qualifying loans Refinanced from elsewhere to Wauna CU. Qualifying loan types include motor home, travel trailer, boat, motorcycle, ATV, and watercraft. Special terms are subject to change without notice. The loan range to qualify for the promotional terms is $2,000 to $49,999. Approved loans qualify for 60-Days No Payments (interest will continue to accrue during the 60-Days period) plus a VISA Gift Card based on the loan amount: $50 (loan $2,000-$4,999), $100 (loan $5,000-$14,999), $150 ($15,000-$24,999), and $250 (loan $25,000-$49,999). Rates & terms offered based on applicant’s credit worthiness and term of loan. RV-Toy Loan rates start at 4.75% APR for up to 48-months; other rates and terms are also available. Membership with Wauna CU required.