How financially savvy are your kids?

Only about five percent of adults received any kind of financial education in school. This is a very sobering statistic and may even somewhat explain why consumers’ credit card and student loan debt is so high.

If you want to equip your kids with the tools to be financially secure adults, a good place to start is with a savings and/or checking account at a credit union. Once they see money going in and coming out, it can drive home a lesson about money management.

Wondering if they can handle the responsibility? Read on…

Savings accounts

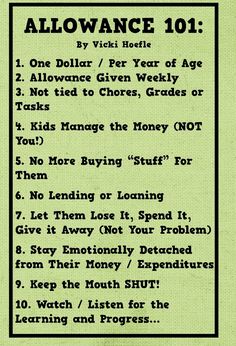

Most kids can typically grasp the concept of a savings account early in their development. Here’s how to know if your children are ready to use one:

They’re curious about money

If your child expresses a genuine interest in coins, shopping, or anything related to money, this can be a good segue into a savings lesson: financial institutions allow you to put money aside until you really need it.

Their piggy bank is overflowing

If your kids have a lot of change in their piggy bank or saved elsewhere, watch out. It may disappear before your eyes! Make this an opportunity to teach them that if they save some of their money in an account, it can earn interest over time.

They have a savings goal

If your children are saving up for something big, this is the perfect time to introduce a savings account. They can make a deposit into the account so that they will not be tempted to spend all of their cash.

Checking accounts

Checking accounts tend to be suited better to older kids who have had more exposure to money. Here are some signs that your kids could benefit from a checking account:

They’re responsible

No matter how responsible you are, it can be tempting to withdraw more cash than you should. You might wait to open an account with your children until they demonstrate responsibility in other areas such as getting a drivers license or maintaining a part-time job.

Their school doesn’t teach personal finance

Most schools fail to teach basic concepts of personal finance, which means that it is up to you as a parent. A checking account can be a great way to reinforce lessons about not spending more than you have, using a debit card, and more.

All their cash is stuffed into their wallet

The wallet-as-checking-account is dangerous for several reasons. Not only can cash easily get lost, it’s hard to track your purchases. By contrast, an account statement lets you view all of your spending and withdrawal activity, which can be a handy budgeting tool.

If you’re eager to introduce your children to the world of personal finance, a credit union account is a good place to start. Just watch for the signs, and start when your kids are ready. You can learn more and even earn prizes during this month’s Credit Union Youth Month celebration at Wauna Credit Union.

If you’ve been meaning to talk to your kids about money, April is the perfect time to start. In addition to

If you’ve been meaning to talk to your kids about money, April is the perfect time to start. In addition to