If you’ve been meaning to talk to your kids about money, April is the perfect time to start. In addition to National Credit Union Youth Month, April also marks National Teach a Child to Save Day. So, in the spirit of occasion, here are three real-world experiences that parents can use to introduce kids to personal finance.

If you’ve been meaning to talk to your kids about money, April is the perfect time to start. In addition to National Credit Union Youth Month, April also marks National Teach a Child to Save Day. So, in the spirit of occasion, here are three real-world experiences that parents can use to introduce kids to personal finance.

Have your children make purchases

Purchasing something is perhaps the most direct way to understand how money works. Therefore, it’s a great opportunity for your children. Try including them the next time you make a purchase.

Whether it’s at the supermarket or movie theater, give your kids cash to hand to the cashier, and then have them collect and count the change.

Lesson: Money is used in exchange for goods and services.

Open a savings account with them

There’s no better way to explain saving money to a child than to open an account in their name for this specific purpose.

Show them an actual Wauna Credit Union branch, point out our new Virtual Teller Machines and ATMs, and have them meet our staff. Reinforce the roles that financial institutions play in managing money. After the account is open, create a plan together for making regular deposits.

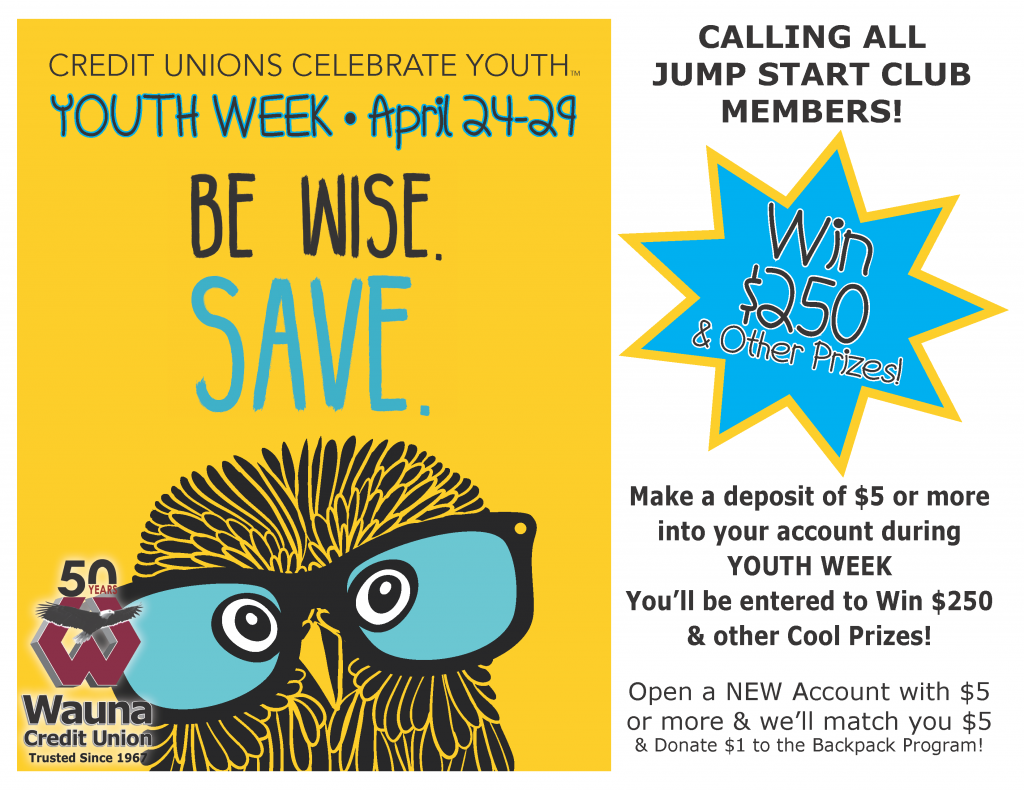

Additionally, throughout April, Wauna Credit Union will deposit the first $5 for all new Youth Jump Start Club Accounts. Members can also enter to win cash prizes by making deposits! Learn more here.

Lesson: While piggy banks are cute, savings accounts are the best option for stashing your cash.

Inspire them to start a business

There’s a reason why lemonade stands have stood the test of time. These micro businesses represent many children’s first exposure to earning money. If lemonade’s not their thing, encourage them to offer pet sitting or yard work to your neighbors.

Lesson: Money is earned through work.

Our young members have limitless potential, and financial education from Wauna Credit Union can be instrumental in helping them achieve it. Swing by one of our branches and celebrate National Credit Union Youth Month.

By staying true to credit union philosophy in an engaging new way, we can set our young members on the path to financial education, understanding and security. We look forward to seeing you — and your future — soon!

Every person is unique, but most people who save regularly developed the habit early on in life. Learning to understand money and save for long-term goals is a crucial life skill, and one Wauna Credit Union is committed to helping our youngest members achieve. Credit Union Youth Week is just one way we do that.

Every person is unique, but most people who save regularly developed the habit early on in life. Learning to understand money and save for long-term goals is a crucial life skill, and one Wauna Credit Union is committed to helping our youngest members achieve. Credit Union Youth Week is just one way we do that.