A lot of us start off the new year with resolutions to improve our financial well-being. Since Wauna Credit Union’s Mission statement is to provide opportunities for our members to improve their financial well-being, we thought we were well suited to help you achieve your resolutions.

Keep Your Savings Safe

For most of us our new year’s resolution boils down to having more money, while we can’t help you earn more money at work, we can help you earn more money on your savings. That’s why we’re excited to offer two new savings opportunities that pay a higher dividend than you’ll get elsewhere. The 9-month certificate has a 2.019% APY and the 13-month certificate has a 2.229% APY.

A lot of people are unsure about certificates, because they really haven’t been something that’s been top of mind, but certificates are really a great way to generate a little extra while keeping your money insured by the NCUA.

For example, if you deposited $50,000 into the 9-month certificate in January you’d have an extra 762 and change at the end of September without lifting a finger. If you chose the 13-month certificate you’d have an extra 1,220.92 at the end of its term.

Maybe just as important, is the money you put into a WCU certificate stays in the community. A lot of our members who are nearing, or in retirement, have certificates since they know the benefits. A lot of those certificates are held by the big national banks, which means your money is used to pay dividends to stock holders, or make loans to big national corporations who have nothing to do with the northwest.

Spend Less and Save More

The other way we can help you is by helping you give less of your money away every month. That’s why we are so happy to bring back two programs, our balance transfer special kicks off on the second of January, and our cash back/no payment special starts mid-month.

The Balance transfer gives you a break on your credit cards. We’re giving people a great introductory rate on balance transfers to a WCU credit card. You get a rate of 2.99% if you transfer a credit card or loan balance to one of our Rewards Visa. To sweeten the pot, we’re also offering 2 rewards points for every $1 you transfer.*

The Rebate promotion frees up your monthly payment for a couple of months, and puts a little bit of cash back in your pocket. Simply refinance an existing loan from another institution with Wauna and you’ll get no payments for 60 days and 1% cashback, up to $500 as a thanks.^

Disclosures

Balance Transfer

*APR-Annual Percentage Rate. The special 2.99% Introductory Rate applies to qualifying balance transfers processed through April 30, 2019. The Introductory Rate will begin on the transaction date(s) during the promotion period, and remain in effect through the 6th billing cycle, at which time the account holder’s original Credit Card Account Agreement terms will apply. VISA Rewards accounts also earn two (2) Rewards Points for each $1 of the approved total balance transferred. Balance transfers from other accounts issued by Wauna Credit Union, or any amount of debt which would cause the account holder’s credit card balance to exceed their credit limit, are prohibited. A Balance Transfer Fee of 3% of the total balance to be transferred, or a minimum fee of $20, whichever is greater, will be assessed at the time the balance transfer request is approved. This special promotional offer ends at close of business April 30, 2019. Complete promotion details available at waunafcu.org. Membership with Wauna Credit Union is required.

2019 Loan Rebate

^Special Promotional Terms: Upon loan approval, current and new Wauna CU members who refinance a loan currently financed elsewhere to Wauna Credit Union qualify to receive: 1. an immediate Cash Rebate equal to 1% of the approved loan value 2. 60-Days No Payments (interest will continue to accrue during the 60-day period); and, 3. Wauna CU will pay the vehicle title transfer fee up to $100 (member is responsible to pay any additional amount). Qualifying Loans: Auto, Truck, SUV, Van, Motor home, trailer, boat, watercraft, motorcycles, side-by-sides, quads, and unsecured loans such as home furnishings, tuition, personal loans, etc.). Minimum loan amount to qualify for special terms: $2,000; Maximum rebate allowed is $500 per qualifying loan. These special, promotional financing terms end at close of business April 30, 2019. Rates & financing are offered based on applicant’s credit worthiness and term of the loan. Note: the promotional cash rebate paid to a member may be forfeit if the loan balance is paid in full within 180-days of the loan funding date. Membership with Wauna CU required to be eligible for this special offer.

Brrrr! For many of us, winter means high energy bills, but sitting in the dark or turning off the heat are not your only options. Here are some ways to improve your home’s energy efficiency and save money during the cold months:

Brrrr! For many of us, winter means high energy bills, but sitting in the dark or turning off the heat are not your only options. Here are some ways to improve your home’s energy efficiency and save money during the cold months:

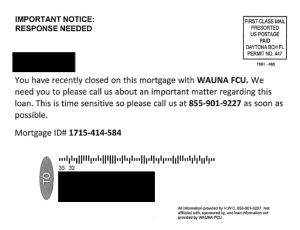

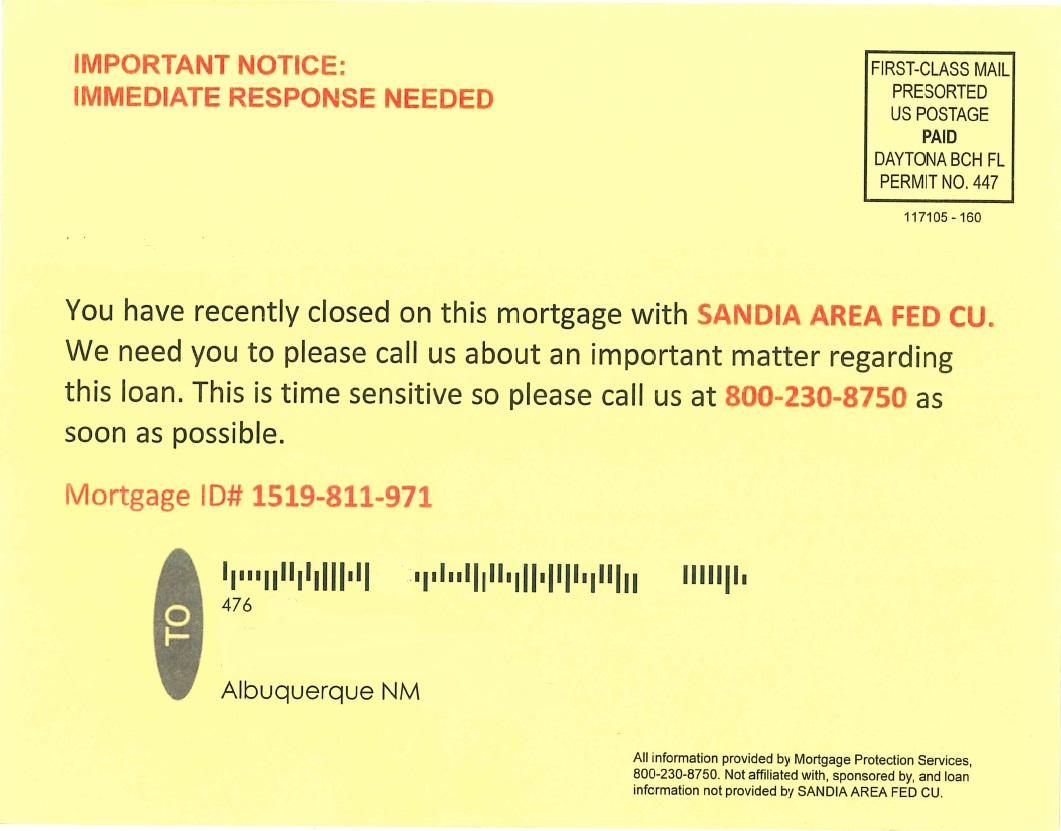

Darn right we called the number. In fact, we tried all the numbers we were able to find. Some connect to a live person, others are recordings, and one dialed directly to an automated system. Regardless of which number, we were eventually probed for personal information. Funny enough, these fraudsters refuse to give out any information about themselves, or even the actual company they are working with.

Darn right we called the number. In fact, we tried all the numbers we were able to find. Some connect to a live person, others are recordings, and one dialed directly to an automated system. Regardless of which number, we were eventually probed for personal information. Funny enough, these fraudsters refuse to give out any information about themselves, or even the actual company they are working with.