Our month-long youth celebration is focused on the theme of “Credit Union Strong”.

Young people face a bewildering financial landscape in their immediate future—one where technology has made spending as easy as breathing and the cost of higher education continues to skyrocket. That’s why we believe it’s more important than ever to ensure our youth possess strong money management skills.

As a not-for-profit financial cooperative, our core values include member education and social responsibility. We care about the community where we live and work, and the people in it. We look forward to watching the next generation grow and make it even better.

By instilling the habit of saving at a young age, offering positive encouragement, and providing financial education, we can prepare our community’s youngest members for brighter futures by helping them grow into financially capable adults. Credit union strong means having the money skills to embrace an awesome future, and leaving your community better than you found. That’s why we take our mission of helping youth so seriously.

Of course, we realize the biggest influence on anyone’s life is his or her parents. So if you want to start your kids on a path to financial strength, participating in Credit Union Youth Month is a good start.

Bring your financial fitness buffs into Wauna Credit Union and help them pump up their savings.

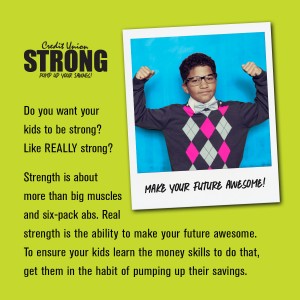

Young People Can Win at Wauna CU!

- Coloring Contests! Prizes will be awarded for Coloring Contest winners!

- Download the coloring sheets: EAGLE / STRONGMAN

- New Jump Start Club members drawing! Win bonus deposits of $25 or $50 just for opening a Jump Start Club account!

- JUST ANNOUNCED! Make a video & Win $100 (All Jump Start Club Members are welcome to participate) – Grab your phone, video camera or other device, and make a quick video, tell us in one minute what you like about Credit Unions, and especially Wauna Credit Union. Post it on any of our social media channels, and we will pick a winner and a runner up! $100 for the winner & $50 for the runner up.

GREAT LINKS FOR KIDS & PARENTS:

- It’s My Life: http://pbskids.org/itsmylife/money/managing/

- Money & Kids: http://life.familyeducation.com/money-and-kids/personal-finance/34481.html

- Teaching Money Management: http://www.debtfreespending.com/teaching-my-son-money-management-with-kids-wealth-kidslearnmoney-ad/

- Articles to teach kids about money: http://www.moneymanagement.org/Financial-Education/Money-Management-For-Kids.aspx

- Great Money Games for kids: http://bizkids.com/games

![unnamed[1]](https://waunafcu.org/blog/wp-content/uploads/unnamed1.jpg)

A new day is breaking on the hills along the mighty Columbia River! Last week, we said goodbye to Randy Brackman, our Internal Auditor and a 28 year Wauna Credit Union veteran. Today, we say hello to a new era, as we welcome Rachel Kamaunu as our new Internal Auditor!

A new day is breaking on the hills along the mighty Columbia River! Last week, we said goodbye to Randy Brackman, our Internal Auditor and a 28 year Wauna Credit Union veteran. Today, we say hello to a new era, as we welcome Rachel Kamaunu as our new Internal Auditor! This week, Wauna Credit Union will experience a major change. It’s not a new branch, or the latest technology, on Friday, March 25th our Internal Auditor Randy Brackman will “punch out” for the very last time!

This week, Wauna Credit Union will experience a major change. It’s not a new branch, or the latest technology, on Friday, March 25th our Internal Auditor Randy Brackman will “punch out” for the very last time!