Wauna Credit Union is growing fast (if you want to join us check out our careers page). The main reason for that is the great service we provide our members. The reason for that great service is our amazing employees. We caught up with a couple who are having their anniversary this month.

Monica Lauber – 13 Years

What is your current position?

I am the VP of Mortgage. I oversee the Mortgage Department, and the great employees who help our members make their home ownership and home improvement dreams come true. I’ve been here a while, and it’s amazing to see Wauna Credit Union grow to offer more-and-more products and services, while staying true to the values of the communities we serve.

What is your favorite WCU memory?

The best thing about this job is my favorite memory changes all the time. Right now it’s helping a member who’s been with the credit union since he was in high school buy his first home. We opened his first checking account, helped him buy a car, and even do business banking with his company. It’s the great thing about being part of a credit union. We get to establish personal and lifelong relationships with our members.

being part of a credit union. We get to establish personal and lifelong relationships with our members.

What is something you like to do when you’re not at work?

My free time revolves around hanging with my family. I love to get out-and-about with my husband Derek and two sons (16 and 8) Magnus and Brokk… It ’s great to see my sons develop their own interests, but also see how they were influenced by us. We are a big jiu-jitsu family so a lot of our time is spent on the mat. I also have 3 adorable American bully’s that love to play.

Jeannie Byrum – 1 Year

What is your current position?

I am a Member Consultant II in the Clatskanie branch. My job is to help members with transactions, open accounts, process loans start to finish, educate on building credit, and help any member with any question they may have. (BTW this is actually a really good description). We have a hip-to-hip service philosophy, which means my number one priority is to get to know our members and really listen to their needs. It’s awesome to have the power to be the one who helps.

What is your favorite WCU memory?

It’s not a specific memory, but any time I get to laugh while doing my job. Sometimes it’s when a member cracks a joke and sometimes it’s just when something unexpected happens during the day. We’re all about getting doing our best, but having fun while we do it.

What is something you like to do when you’re not at work?

I like to adventure with my boyfriend Andrew. Our favorite thing to do around town is go hiking up in the hills or hit the river. When we get out of town we like to stay outdoors and climb Smith Rock, or explore the trails around Mt. Hood. I can be a homebody too. Sometimes there’s nothing better than hanging out at reading a good book, or spending time with friends and family.

Kerbie Belknap – 1 Year

What is your current position?

I am an MC in Astoria. I assist members with transactions, process loans, and answer any questions members might have. I love being one of the faces of the credit union and getting a chance to talk to our members every day.

What is your favorite WCU memory?

My favorite memory has to be the last in service day. We get to chat about how the credit union is growing our products and services to help our members even more. It was so fun to learn more about what we’re doing and see all the people I went to training with, and visit with employees that I don’t get to see often. Our CXO John Moore is quite the DJ, and makes sure that there is plenty of great music and impromptu dance-offs.

What is something you like to do when you’re not at work?

I love to cook, drink wine, watch Netflix, go on vacation and spend time with my two girls and husband.

Others

- Jacob Humphries – 3 years

personal property records for the credit union. We’ve been working on a lot of projects lately, like the Clatskanie remodel and the addition of our Mortgage Origination Office in Long Beach, so there has been (and will continue to be) quite a bit to do for this, which is exciting!

personal property records for the credit union. We’ve been working on a lot of projects lately, like the Clatskanie remodel and the addition of our Mortgage Origination Office in Long Beach, so there has been (and will continue to be) quite a bit to do for this, which is exciting! part in assisting this member.

part in assisting this member.

influence for our members. Our member consultants will sit down with a member whose credit isn’t quite where they want it to be, and go over their credit report, explain what the different notes and indications mean, provide a plan of attack and then periodically check in to apprise progress. Teaming with our members like this is one of the ways we stay true to our goal of being a true member of the areas we serve.

influence for our members. Our member consultants will sit down with a member whose credit isn’t quite where they want it to be, and go over their credit report, explain what the different notes and indications mean, provide a plan of attack and then periodically check in to apprise progress. Teaming with our members like this is one of the ways we stay true to our goal of being a true member of the areas we serve. How long have you been at WCU?

How long have you been at WCU?

and thousands of our current members work in fields like fishing, timber, and food production. We rely on our natural environment for our livelihood and for our recreation. Wauna Credit Union even built the very first LEED Certified Credit Union branch in all of Oregon!

and thousands of our current members work in fields like fishing, timber, and food production. We rely on our natural environment for our livelihood and for our recreation. Wauna Credit Union even built the very first LEED Certified Credit Union branch in all of Oregon!

It was especially great to see children involved in the cleanup. While we know it’s always hard to get kids out in the rain, they had a great time splashing around in the puddles, and helping their parents with the work at hand. Everybody who participated received a free beer, or non-alcoholic drink,

It was especially great to see children involved in the cleanup. While we know it’s always hard to get kids out in the rain, they had a great time splashing around in the puddles, and helping their parents with the work at hand. Everybody who participated received a free beer, or non-alcoholic drink,  Being part of the community is a huge part of who we are, and we’re always happy to partner with our commercial members to help keep the cities we live and work in beautiful. Let’s do it again next year!

Being part of the community is a huge part of who we are, and we’re always happy to partner with our commercial members to help keep the cities we live and work in beautiful. Let’s do it again next year!

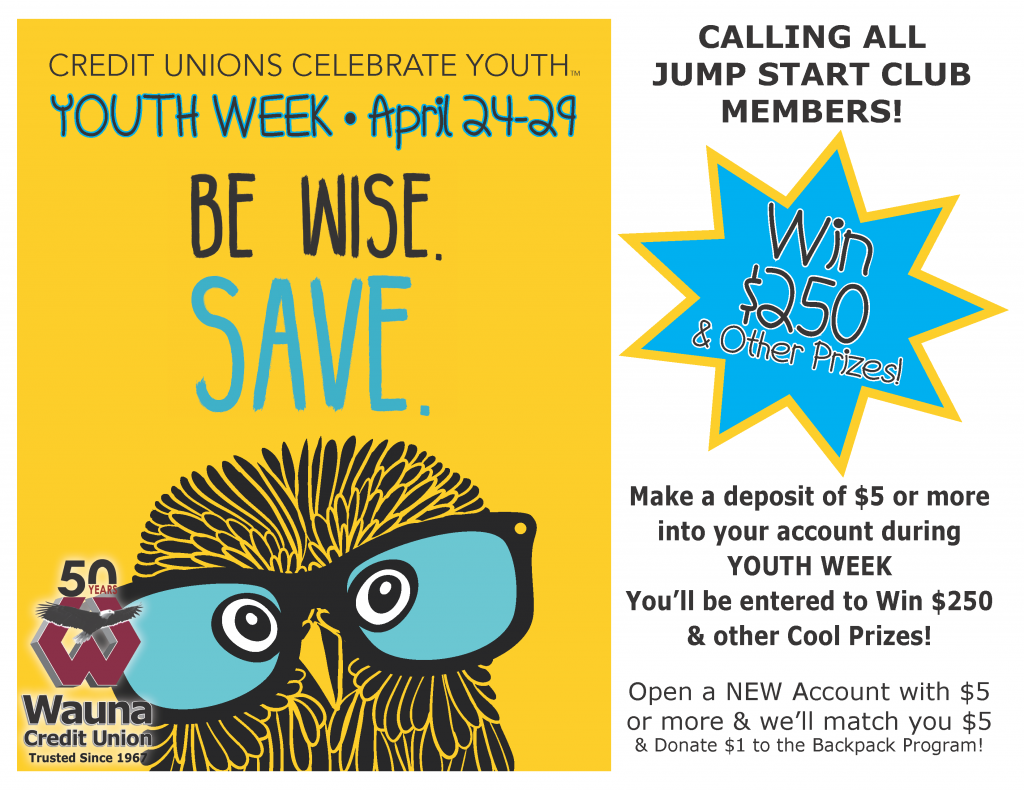

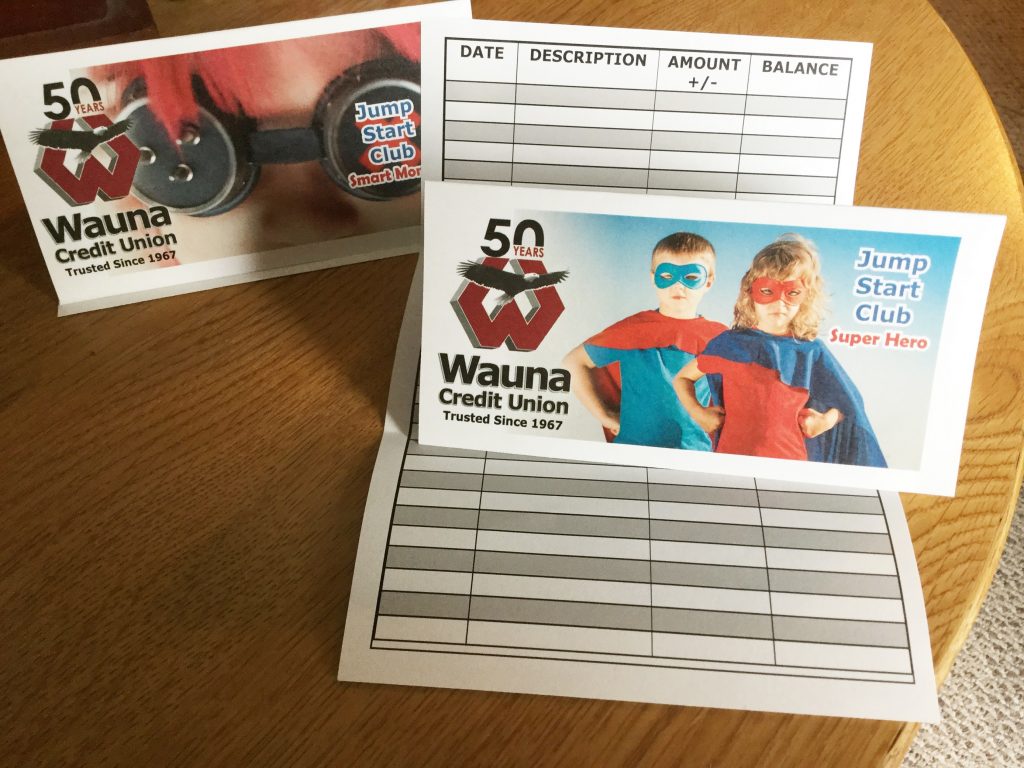

Every person is unique, but most people who save regularly developed the habit early on in life. Learning to understand money and save for long-term goals is a crucial life skill, and one Wauna Credit Union is committed to helping our youngest members achieve. Credit Union Youth Week is just one way we do that.

Every person is unique, but most people who save regularly developed the habit early on in life. Learning to understand money and save for long-term goals is a crucial life skill, and one Wauna Credit Union is committed to helping our youngest members achieve. Credit Union Youth Week is just one way we do that.

That plastic in your pocketbook is the greatest enabler of bad money habits, allowing you to spend on a whim and forsake all budget plans. Sticking to a budget should be your

That plastic in your pocketbook is the greatest enabler of bad money habits, allowing you to spend on a whim and forsake all budget plans. Sticking to a budget should be your

increasing your income and savings — will be worth the work in the long run.

increasing your income and savings — will be worth the work in the long run. couple of years was such a great decision. Whether somebody is getting their first house, their fifth, or taking advantage of our great HELOC special to add the master bedroom they’ve always wanted, I get to be part of our members realizing their dreams.

couple of years was such a great decision. Whether somebody is getting their first house, their fifth, or taking advantage of our great HELOC special to add the master bedroom they’ve always wanted, I get to be part of our members realizing their dreams. technology troubleshooting.

technology troubleshooting.