Wauna Credit Union has been serving members of the towns and cities surrounding the Columbia River for 51 years. We’re continuing to grow (if you want to join us check out our careers page). Employees celebrating July Anniversaries are all firecrackers who exploded onto the scene at WCU.

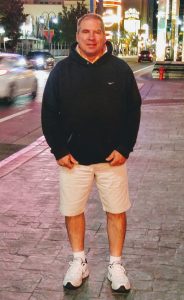

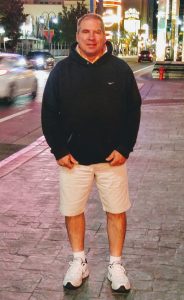

We also have one more special anniversary in July. CXO John Moore is celebrating 5 years at the credit union. Read all about him, and how Xs and Os don’t just mean kisses and hugs here.

Richard Bighill – 22 years

What is your current position?

My current position is Lending Support Clerk. My job is to help support the Lending Support Specialists, Lending Support Manager, and VP of Consumer Loans. My duties ensure that the others do not have to complete them while underwriting, processing, and funding loans.

My current position is Lending Support Clerk. My job is to help support the Lending Support Specialists, Lending Support Manager, and VP of Consumer Loans. My duties ensure that the others do not have to complete them while underwriting, processing, and funding loans.

What is something that working at WCU has taught you?

Something that working at WCU for 22 years has taught me is that it is very important to be part of the WCU family, and help support others.

If you could choose one new hobby what would it be?

I’m a huge Seahawks fan, so any new hobby would have to involve them. Maybe I’d become a sports photographer.

Sue Whitton – 11 years

What is your current position?

I am the Member Service Manager for the Vernonia Branch. In my position I oversee the front line operations. I believe the MC position is the most important contact for our membership. We start the relationship and help grow the membership through developing trust.

What is something that working at WCU has taught you?

Wauna has taught me how important it is to support the community. Wauna has a strong commitment to the community, and I am proud of being able to support Vernonia.

If you could choose one new hobby what would it be?

My hobbies currently are adjusting to empty nesting and It is going very well. Thank you!

Heidi White – 6 years

What is your current position?

I’m a Member Consultant. in the Clatskanie Branch. I assist our members with their every-day banking needs, as well as help them prepare for the future, whether that’s figure out the best way to save for a life milestone, or get a loan to buy a new car.

What is something that working at WCU has taught you?

Growing up in Clatskanie I felt like I knew everybody in the community, but working here has taught me how to figure out a way to build rapport with anybody. No matter if they’re from out of town, just out of school, or getting ready for retirement, people want to know that the person helping them is looking out for their best interest.

If you could choose one new hobby what would it be?

Can I pick two hobbies? I want to travel all over the world and do fun crafty things. Maybe my new hobby would be to have an international craft store.

Kristen DeForrest – 2 years

What is your current position?

I currently work as the Member Service Manager at the Astoria Branch. Previously I managed the branch inside the Astoria Safeway. I am passionate about building dynamic team of member consultants who are passionate about Wauna Credit Union’s mission and vision. It is important to me that we help members at every stage of financial success, but I especially enjoy helping youth with our jump start program.

What is something that working at WCU has taught you?

Working here has taught me that no matter how much you prepare you still need to be ready for things to change. That is something I am constantly helping our members with. We are here to help people deal with all of life’s milestones, whether they are planned or not.

If you could choose one new hobby what would it be?

I just started a new hobby! I have recently committed to supporting the Mariners Baseball. I’ve watched almost all the games this season, and hope to attend one this year with my family, including my daughter Claire, who is 6-months old-and much more than a hobby.

Lisa Clark – 1 year

What is your current position?

I’m the St. Helens/Scappoose Area Manager. My job is to supervise the deposit and lending operations for those assigned branches. I’m to coach and lead the Member Service Managers in those branches and to ensure that my branches are providing the highest quality member service. I also get to do business development, commercial lending and some public relations in Columbia County. All in all, I’m to ensure that my assigned branches are reaching their goals and are profitable.

What is something that working at WCU has taught you?

WCU has taught me so much, but one of the great things is that being yourself is really important. We’re taught to have real conversations with our members, and really listen to them to make sure we are helping in every way we can. Sometimes I go to other places and it’s like a robot is helping me. By being myself, I’m not only having fun, but providing great member service.

If you could choose one new hobby what would it be?

One new hobby would be to learn to play a music instrument. My whole family is musical and I’m the only one who can’t play an instrument. My kids say that the only thing I can play is the radio!

Meisha Boettcher – 1 year

What is your current position?

Member Consultant II. Which means I act as a teller doing transactions sometimes; I act as a loan officer other times. I can be a therapist or an auditor depending on the day. Every day has a new challenge and a new lesson. I really enjoy that aspect of my work.

What is something that working at WCU has taught you?

That everyone has a story and each one is important. Whether it’s a loan or a simple transaction, our interaction with that member is part of their day and part of their life. I’ve found it to be very enjoyable to be involved with people like that and get to know them over time.

That everyone has a story and each one is important. Whether it’s a loan or a simple transaction, our interaction with that member is part of their day and part of their life. I’ve found it to be very enjoyable to be involved with people like that and get to know them over time.

If you could choose one new hobby what would it be?

I’ve always been in awe of aerial silks, I attempted a little in high school but I never went anywhere with it, I wish I would have. If I had the time and setup to do that, you bet I’d be in amazing shape and I’d be having a good time doing it.

Others

- Carli Lyon

- Jan Durie

- Amber Alexander

- McKenzie Lewis

- John Kurns

If you’ve ever let a debt go unpaid, your creditor probably sent it to a debt collector. Debt collectors are serious about getting you to pay. That’s why part of their strategy is to list the unpaid account on your credit report. This in turn damages your credit score, and appears on your report for future lenders to see. Your collection will remain on your credit report for up to seven years.

If you’ve ever let a debt go unpaid, your creditor probably sent it to a debt collector. Debt collectors are serious about getting you to pay. That’s why part of their strategy is to list the unpaid account on your credit report. This in turn damages your credit score, and appears on your report for future lenders to see. Your collection will remain on your credit report for up to seven years.

Buying a home is a major commitment. It’s a bit like, well, getting married. You’ve got to be ready and you have to find the right “one.” And, like a marriage, homeownership is a dynamic experience that requires a tremendous amount of care and attention. If you are ready to shift from renter to buyer, you’ve got some legwork to do.

Buying a home is a major commitment. It’s a bit like, well, getting married. You’ve got to be ready and you have to find the right “one.” And, like a marriage, homeownership is a dynamic experience that requires a tremendous amount of care and attention. If you are ready to shift from renter to buyer, you’ve got some legwork to do. My current position is Lending Support Clerk. My job is to help support the Lending Support Specialists, Lending Support Manager, and VP of Consumer Loans. My duties ensure that the others do not have to complete them while underwriting, processing, and funding loans.

My current position is Lending Support Clerk. My job is to help support the Lending Support Specialists, Lending Support Manager, and VP of Consumer Loans. My duties ensure that the others do not have to complete them while underwriting, processing, and funding loans.

That everyone has a story and each one is important. Whether it’s a loan or a simple transaction, our interaction with that member is part of their day and part of their life. I’ve found it to be very enjoyable to be involved with people like that and get to know them over time.

That everyone has a story and each one is important. Whether it’s a loan or a simple transaction, our interaction with that member is part of their day and part of their life. I’ve found it to be very enjoyable to be involved with people like that and get to know them over time. Are you looking to generate income from your savings? Why not have your hard-earned money get out there and work for you? Well, we can certainly help by getting you started in either a Money Market or Certificate account.

Are you looking to generate income from your savings? Why not have your hard-earned money get out there and work for you? Well, we can certainly help by getting you started in either a Money Market or Certificate account.