One of the things that makes Wauna Credit Union special is our Mission to provide opportunities for our members to build their financial well-being. If you live, work, attend school or worship in Clatsop County, Columbia County, Western Washington County, or Pacific County Washington, we want to help you realize your financial goals. Sometimes, that is very hands by providing personal loans, mortgages or credit cards to help you grow. We pride ourselves on is our commitment to helping provide financial education to all our members. Sometimes this takes the form of our credit enhancement program, where we sit down with a member whose credit isn’t quite where they want it to be, and go over their credit report and help them make a plan to improve it. But financial education isn’t only us telling members what they need to do, one of the features we offer is BALANCE, which offers a ton of ways for members to take control of their finances.

What is BALANCE

BALANCE offers amazing personal budgeting tools to help our members improve their money management skills. Some of the things it offers are housing counseling, assistance making a debt repayment plan, a credit report review, and a toll-free information line, all free to Wauna Credit Union members. BALANCE also offers educational modules on a variety of subjects related to money, saving and spending goals. Read the modules or listen to many of them on podcasts and improve your relationship with money forever.

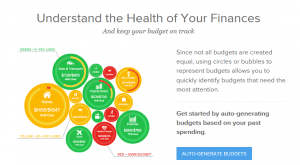

MoneyDesktop and MoneyMobile

MoneyDesktop is available directly from Online Banking. It gives members an easy and secure way to track finances and budget. You can add any account you want, whether it’s with us, or somebody else to get a full view of how you spend your money. Members can also download the free MoneyMobile app and take all of that information with you wherever you go.MoneyDesktop & MoneyMobile allow members to visualizes their spending as well. They both are great ways to offer help you take control of your finances.

We really hope that members can take advantage of these great free programs Wauna CU offers.

Implementations. My vision is to lead and build a strategic team that improves our products & services; implements innovative technology, and ensures that members hear about all the ways we can help them achieve their financial opportunities.

Implementations. My vision is to lead and build a strategic team that improves our products & services; implements innovative technology, and ensures that members hear about all the ways we can help them achieve their financial opportunities.

especially if it’s several decades away. Experts say that to keep your same standard of living, you’ll probably need at least 70% of your pre-retirement income.

especially if it’s several decades away. Experts say that to keep your same standard of living, you’ll probably need at least 70% of your pre-retirement income. your retirement savings each year to help ensure that it lasts. That means to get $35,000 in income, you’d need a savings target of about $875,000.

your retirement savings each year to help ensure that it lasts. That means to get $35,000 in income, you’d need a savings target of about $875,000. the money you contribute. You then

the money you contribute. You then

through February 26, 2017 all members age 18 or older who are in good standing are eligible to cast a ballot, either online, by mail or on Facebook.

through February 26, 2017 all members age 18 or older who are in good standing are eligible to cast a ballot, either online, by mail or on Facebook. Monica was talking about her.

Monica was talking about her. loans cover many different things, including medical bills, household improvement or auto repairs. The Lifestyle Loan is a great option for somebody looking for a little extra money for a wedding ceremony, reception, rings, honeymoon, or even the little miscellaneous costs that always seem to pop up.

loans cover many different things, including medical bills, household improvement or auto repairs. The Lifestyle Loan is a great option for somebody looking for a little extra money for a wedding ceremony, reception, rings, honeymoon, or even the little miscellaneous costs that always seem to pop up. ISA to help younger members establish credit.

ISA to help younger members establish credit.